The company is primarily in the business of building and selling homes to entry-level home buyers in the U.S. The company went public via its IPO in Nov 2013 and has grown from selling about 1617 homes across 5 states in 2013 to selling 6729 homes across 21 states in 2023.

Source: Definitive Proxy Statement 2024

The company’s CEO/Co-founder Eric Lipar and his management team initially started off in the residential land development business in the mid-1990’s and commenced home-building operations in 2003. Since commencing operations, the company has been profitable every year and has never taken an inventory impairment!

Source: Q4 2019 Earnings Call

The company has a unique culture of being very process/systems oriented to drive efficiencies. A few examples of their unique operating model:

Land Acquisition:

Allocation of capital for land investment is performed at the corporate level. The acquisition committee consists of the CEO, CFO, and Executive VP of Acquisitions.

The company tests the market for renters before acquiring land. Typically, they would like to see ~40,000 renters within a 25-mile radius of the target land acquisition. They also focus on land that is further away from urban centers than many other suburban communities but have access to major thoroughfares, retail districts, and centers of business.

Move-In Ready Homes: The company focuses on move-in ready homes for buyers, with 4-6 floor plans per community and no options. This streamlines the construction process to keep costs down and offer competitive prices to customers.

Job Manual: Every position in the company has a manual for reference.

Extensive Employee Sales Training: New hires go through a 100-day training program which includes 30 days of initial in-depth education about the company’s selling strategies, including a 2-week intense training program at the company’s headquarters combined with an additional 70 days of secondary training at the local division.

Continuous Learning: Quarterly regional training events and an annual company-wide conference. The company also works closely with subcontractors and construction managers, training them using a comprehensive construction manual that outlines the most efficient way to build an LGI home.

Recognizing Talent: The company recognizes its top salesperson of the month by displaying their picture at the Nasdaq Tower in Times Square. It is also one of the reasons the company took a NASDAQ Listing vs other Exchanges.

Source: Company Linkdin page

Now, let’s examine how the company has performed since its IPO and where they are headed.

The company has almost 3x the home closings since 2014 (1st full year since IPO) and almost increased revenues 6x!! Naturally, anyone analyzing this business would likely think, what about the bottom line? Have they grown at the expense of profits? and what happened after 2021? (will get to this in a bit).

Diluted EPS in 2023 is ~6x 2014 levels! Impressive in my opinion.

I really like companies that provide multi-year financial results readily in annual reports/presentations. I consider it as one of the signs of an honest management team who thinks long-term.

The company is run by its co-founder Eric Lipar, who owns a substantial stake (~9.8% of shares outstanding) in the company. The CEO/management team is driving the company for long-term success even if it means at the expense of short-term profit. During the Covid home buying mania, the company sold record amounts of homes (see 2021#s), and as buying finished lots became expensive the company shifted its strategy to buying raw land for development. This substantially decreased their home sales in 2022 and 2023 as it takes 2-3 years to develop raw land into active selling communities, but the management refused to take part in the mania of buying finished lots at crazy prices.

Source: 2021 Annual Report.

As a result of buying raw land, the company’s Inventory has ballooned over the last few years. As more communities are built, the inventory should grow at a slower pace than revenue growth. Keep in mind this is still a growing company.

Source: CEO in 2024 Q1 Call

One of the long-term goals of the company is to become a Top 5 home builder in the U.S. The company doesn’t have a specific timeline on when they will achieve this as they probably don’t want to box themselves to a specific timeline if they can’t reach the goal profitably. They were ranked the Top 15 builder based on 2023 sales by Builder magazine (Link: Top 100).

Based on historical results, I believe the company strives to achieve 25% gross margins and 20-25% ROE however they are currently struggling to achieve this number due to the tough sales environment as a result of increased borrowing rates for consumers and inflation affecting home building cost. I don’t have a very nuanced view of where interest will be in the future and if we are currently at the top of the home-building cycle but I do know the below:

When interest rates were higher in the prior decades people still bought homes. Millennials entering home buying age is set to increase over the next few years which should be a tailwind for the company.

Source: Green Brick Partners Q1 2024 presentation

There was a shortfall in U.S. housing construction in the last decade. Even during that difficult time LGIH grew and maintained margins.

Source: Hovnanian May 2024 Investor Presentation

There is still a long runway for growth for LGIH, as they account for less than 1% of the yearly new single-family housing starts.

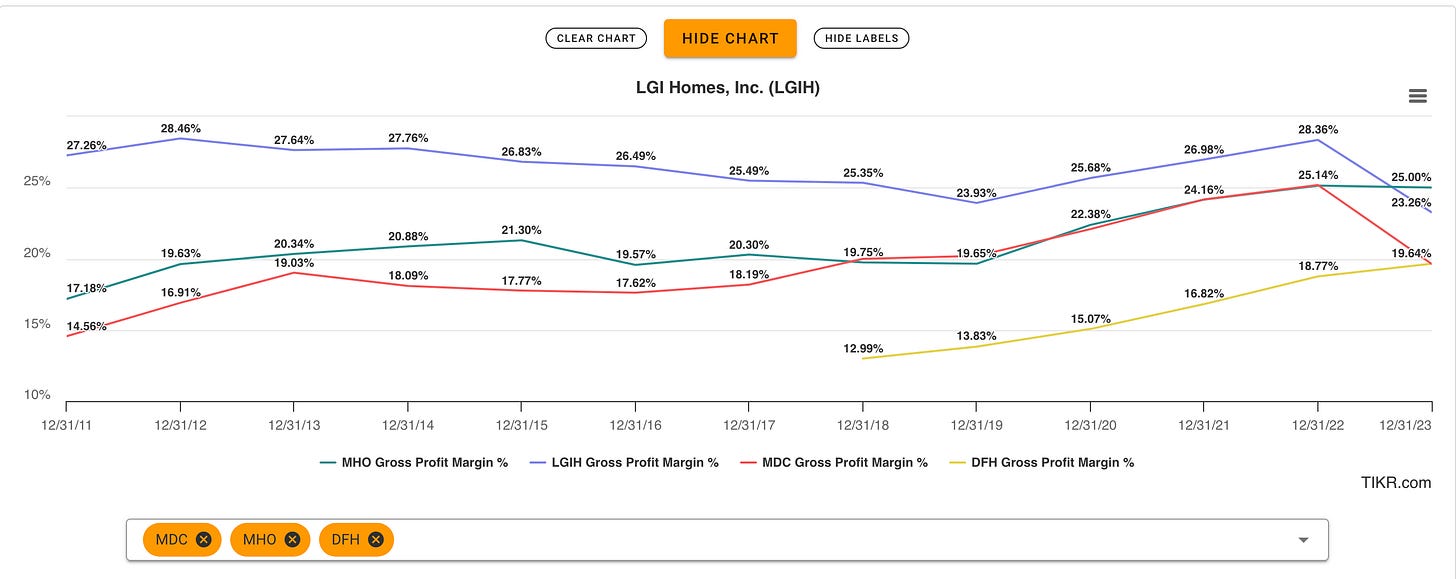

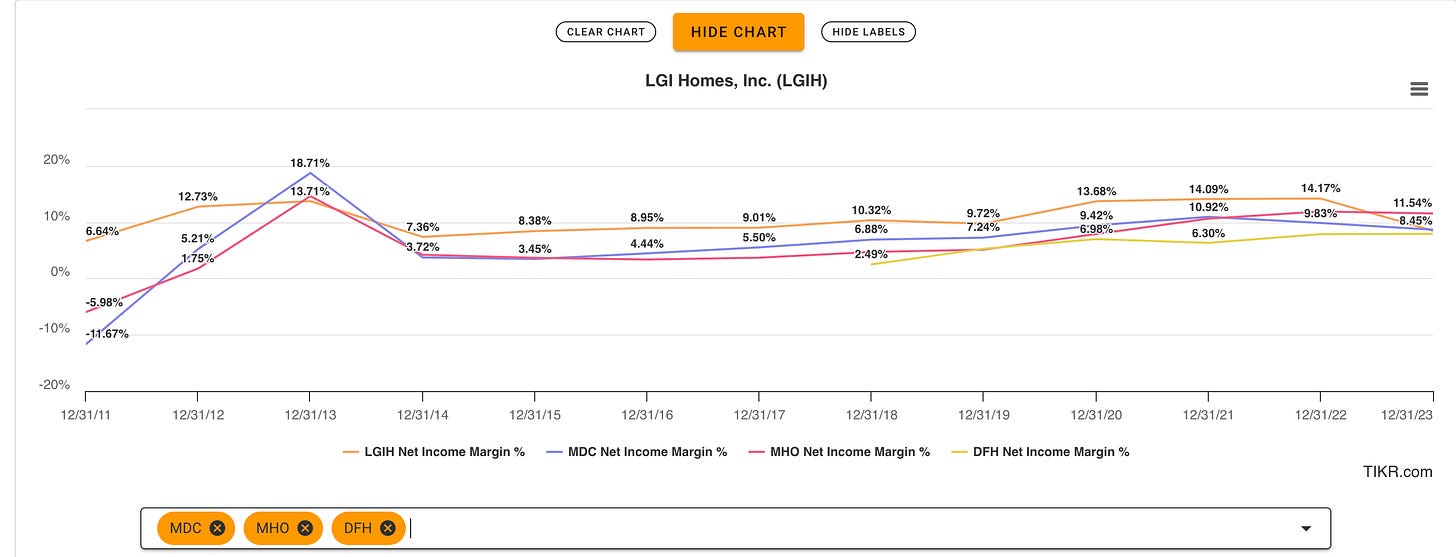

LGIH is one of the most efficient home builders in their class (see Gross Profit margin, ROE, Net Income margin) with their process-oriented culture.

For obvious reasons, I haven’t compared LGIH to D.R Horton(Top home builder in the U.S.) in the above graphs but even if I did, they compare well. Keep in mind Net Income Margins have taken a hit for LGIH recently with their inventory build and lower sales volume, but that should improve in the long run.

Management interest is aligned with the rest of the shareholders.

The company’s guidance for 2024 was between 7,000 - 8,000 homes, ending with ~150 active selling communities and average sales price between $350K-$360K. With gross margins between 23.1%-24.1%, SG&A expense in the range of 12.5% and 13.5%, and tax rate in the range of 24%-25%.

Source: Q4 2023 Earnings Call

We can use the above to estimate to arrive at a min-max EPS range for 2024. The company has reduced share count every year since 2019 and yet I have kept shares outstanding flat from YE2023 to calculate 2024 EPS.

At current price/share (June 26 2024) of $88.61, the 2024 estimated earnings yield is in the range of 9%-11%.

A couple of things to keep in mind, one could wonder, if they have debt and why is there no interest expense? The interest expense is capitalized and part of COGS, so the gross margin already accounts for it. Also, the company earned ~$28M in 2023 and 2022 from rental income and investments, which I have not included. Let’s consider that as Margin of Safety.

Below are my conservative estimates for the future. The growth rates I have considered are much lower than their historical rates. For most of the years since 2013, the company has grown its community count by over 20%, and I have considered 10%. In the past the average absorption per community per month has been over 6, I have considered 5.4 to be conservative. I have also reduced share count YoY by 3% assuming the company buys back shares opportunistically to owners as they don’t pay a dividend.

As with most estimates my estimate will be proved wrong over time, all I want to understand with this exercise (assuming low terminal risk) is if the company’s conservative future earnings provide a good (10-15%) earnings yield (compared to the current share price) with potential for additional upside.

To get a sense of the long runway for the company take a look at the above table in which the company’s estimated Homes (sale) hits ~13,000 in 2028 and it could probably take >17,000 home sales/year in 2028+ to hit their long term goal of being a Top 5 builder. Below is the 2024 Top 5 builder rank list.

Source: https://www.builderonline.com/builder-100/builder-100-list/2024/

The company faces similar risks as any other homebuilder however with management being part owners, prudent operators, and a history of navigating difficult environments, I believe over the long run, and through the inevitable cycles, the investment to be satisfactory.

Disclaimer: I own shares of LGIH. Nothing on this blog is investing or financial advice. Please see full disclaimer here.