NORTH AMERICAN CONSTRUCTION GROUP LTD (TSX:NOA.TO / NYSE:NOA)

LOW COST CONTRACT OPERATOR WITH SIGNIFICANT SCALE

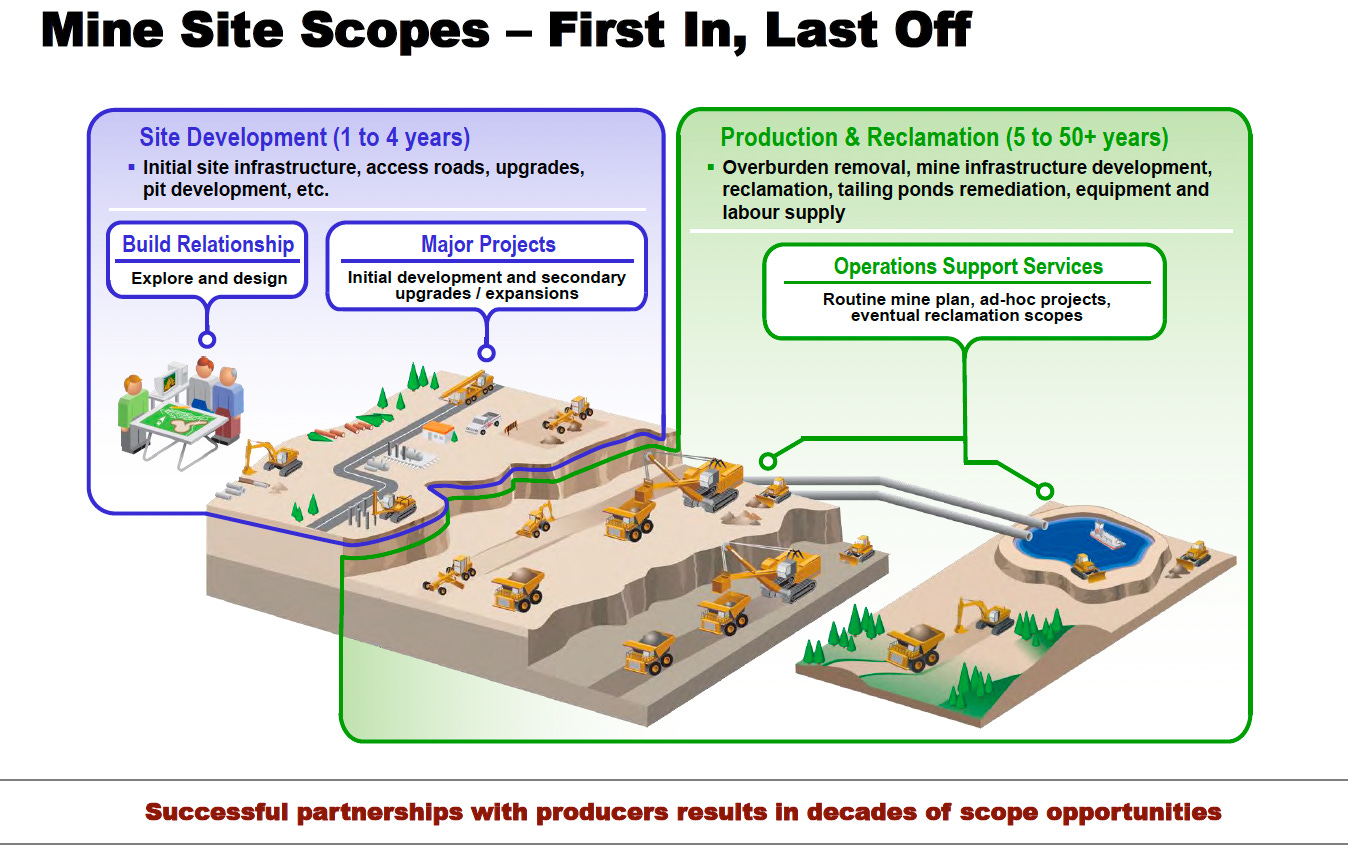

North American Construction Group provides mining and heavy construction services to customers in Canada and the United States. Their services are primarily focused on supporting the construction and operation of surface mines, and are considered to be a “first-in, last-out” service provider as they provide services through the entire lifecycle of the project.

In simple terms, the company gets paid to move dirt.

Note: All $ values mentioned in the article are in CAD, unless otherwise mentioned.

The company has a rich history of over 65 years. They initially started under the name North American Road Builders in 1953 and during the 1970s started to focus on working for energy producers like Suncor and Syncrude. The company grew its reputation as the oil sands producers became major producers of oil. In 2003, the company was sold to a Texas investment group in a leveraged buyout. The company went public in 2006 under the name North American Energy Partners and later changed the name to North American Construction Group in 2018 to better reflect their business and aspiration to have a more diversified operation.

When the company went public they were loaded with high-interest debt and in 2012 there was a change in management when Martin Ferron joined the company as CEO. Some of the key things he focused on were:

Restructuring and reducing debt

Divest non-core assets

Diversify revenue from oil sands to other resource industries

The company sold its Pipeline and Piling related assets in the next 2 years and used the proceeds to reduce debt and associated interest costs. You can see in the chart below how the interest expense has been lowered over the years since Martin took over as CEO. The team also took the opportunity to reduce shares outstanding through NCIB and all of these were very shareholder-friendly actions by the management team.

The team also made tremendous progress on diversifying to other resource industries and in 2021 was able to hit 50% Adj EBIT from non-oil sands. You can see their progress below:

You can divide the Company’s operations into two:

Oil Sands Operation

Non-Oil Sands Operation

OIL SANDS OPERATION:

Source: https://www.osti.gov/etdeweb/servlets/purl/21403708

One needs to remove the overburden to access the resource (Oil Sands). Most of the overburden is removed by the producers but about 10% of the work is contracted out. NACG (North American Construction Group) estimates that they capture about 70% of this contracted work, which shows their scale and competitive edge.

The majority of services provided in the oil sands region by the company are being completed through the Mikisew North American Limited Partnership. This joint venture performs the role of a contractor and sub-contracts work to the NACG. The majority partner of Mikisew North American Limited Partnership, the Mikisew Group of Companies is directly owned by the Mikisew Cree First Nation.

NACG mainly derives revenue from 4 major oil sands customers i.e Suncor, Syncrude, Imperial Oil Limited & Fort Hills Energy. The company strives to be the lowest-cost service provider in the region by continually improving its operations and working closely with its customers.

In 2018, The company acquired ~180 machines of AECON’s (Competitor) heavy equipment fleet, as they were exiting the business, for $198M and onboarded 450 personnel. NACG also opened a newly constructed ($28M) major equipment maintenance and rebuild facility with a corporate office attached. With the success of maintaining its fleet and rebuilding 2nd life machines, In 2020, NACG opened a newly constructed component rebuild facility.

In 2021, the company acquired DGI Trading Pty Ltd in Australia for the sourcing and procurement of equipment components for $18.4M.

These moves have tremendously decreased costs for the company and act as a competitive edge not just for their oil sands operation but for their other areas of business as well.

NON-OIL SANDS OPERATION:

The company in its quest to move towards a diversified revenue source acquired a 49% ownership interest in Nuna Group of Companies for $42.5M in 2018. Nuna is a well-established incumbent contractor in Nunavut and the Northwest Territories. Nuna’s revenue relates to commodities such as base metals, precious metals, and diamonds as well as infrastructure projects that involve major earthworks. Nuna’s peak business activity occurs during the summer months which is generally when the oil sands activity is low.

NACG and its joint venture partners (Acciona and Shikun &Binui) called the Red River Valley Alliance, won a landmark flood mitigation project in the United States in 2021. The US $2.74B project includes operations and maintenance for a 30-mile river diversion channel around the Fargo-Moorhead-west Fargo metro area. NACG’s share of the project is about ~$650M (CAD).

The company also moved into coal mine operations to further diversify its business. In 2019, NACG executed a 5-year Management Services Agreement (MSA) to operate a thermal coal mine in Wyoming, USA which serves an adjacent power plant. In 2020, NACG executed a 5-year MSA to operate a thermal coal mine in Texas, USA building on its previous experience.

Most of the Non-Oil Sands Operations revenue flows through equity earnings as a result of the various joint ventures the company has. It does get a bit confusing as the company enters into various joint ventures to bid for individual projects. Ex: For the Norther Ontario Gold mine project, the company (NACG) created a joint venture (50-50 partnership) with Nuna (Of which NACG owns 49%) so the earnings associated with Nuna go through equity earnings while the earnings associated with NACG go through normally. They do this not to confuse us investors but to create an entity that has the best chance of winning a bid.

BACKLOG:

The company’s contractual backlog sits at $1.6B and they have line of sight to exceed the backlog by $2B by year end. Nothing speaks louder of the company’s progress than the fact that less than a decade ago in 2013 the company’s backlog was at 16% ($256M) of the current backlog.

The company’s bid pipeline has over $4B of work over the next few years. They are not going to win all of it but surely some.

MANAGEMENT:

The company has made tremendous progress towards profitability, decreasing interest expenses and debt, business diversification, as well as building a culture of safety and cost consciousness since 2012 when Martin Ferron was made CEO. Martin retired as CEO at the end of 2020 but moved to an executive Chairman role until 2021. Joseph (Joe) Lambert was appointed as President and CEO in 2021, he has been with the company since 2008 and was president and COO before being appointed as CEO.

Martin Ferron owns about 7% of the shares outstanding and still sits on the board as Chairman(Not Executive Chairman). His interest should align with the other shareholders of the company.

There are a few things I am not a fan of :

CEO Transition Plan and Pay: Martin was made Executive chairman in 2021 (just for a year) and got paid more than what he earned as CEO the prior year. I don’t see this as a good succession plan by the board if the previous CEO needs to be an Executive Chairman and take huge pay while the new CEO who has been with the company for so long gets settled.

This is my biggest negative view of the company! Not the oil sands operation or the joint ventures or the cyclicality of the business but this!

I hope this is in the rearview mirror as Martin transitioned to being a chairman (Not Executive) of the board in 2022 and hope his pay is in line with other board members.

Board of Directors: A few members of the board of directors hold no common shares of the company. I don’t see this as a good sign or good governance by the rest of the board. Just reaffirms the lack of governance mentioned in the previous point.

COMPETITIVE ADVANTAGES:

A strong relationship with customers as a result of being in business for over 65 years

Massive Scale, they move about 70% of the total contracted overburden volume in the oil sands

Strong partners in Joint Ventures

Low-cost operator due to investments in equipment and component rebuild facilities

Diversified business and associated earnings

RISKS:

Customer concentration risk within the oil sands operation. I don’t see this as a huge risk because the producers have been using contractors to move material and peak shave for decades. I see contractors as a necessity to de-risk the operation, Imagine being a producer and owning your equipment and when you want to increase production you will have to buy new equipment worth millions to use just for a few years or be unable to produce at capacity due to equipment availability. Producers move 90% of the overburden just 10% is contracted out. Also, NACG doesn’t just move overburden they also construct & maintain roads, prepare sites, and construct tailing ponds which they have had decades of experience with. I don’t see producers moving to this area which is non-core to them.

With NACG being one of the low-cost operators (if not the lowest) and having diversified their business they have de-risked this.

Safety: They had a fatality at one of their site operations in 2022. The incident involved two haul trucks that collided. I believe the company has a culture of safety but more of such incidents would hurt the company’s business and ability to retain employees.

Unit Price Contracts: ~41% of the company’s 2021 revenue was derived from unit-price contracts. Unit-price contracts require the company to guarantee the price of the services they provide and thereby potentially be exposed to losses if the estimates of project costs are lower than the actual cost incurred. In the past, the company has been successful in re-negotiating contracts with the oil sands producers as well as being open to negotiations when the producers were facing a pinch during the low oil price environment. These make me feel confident in their oil sands operations however I am not confident in their ability to pass on increased costs (beyond their assumptions) for their newer projects like the Fargo-Moorhead project, especially in an inflationary environment.

Source: Tikr; Q2 2022 call

Joint Ventures: They could be risky if the JV partner backs out as NACG through the JV would still be liable for the contract. But I see this as low risk as their JV partners have been in operation for a very long time.

Debt: The company has increased its debt over the years as they have grown operations, I don’t see this as a huge risk due to its lower interest expense and visibility to cash from operations due to long-term contracts with customers.

VALUATION:

METHOD 1: DCF

The company is forecasting FCF from operations in the range between $65-$95M for 2022, I have taken $60M of FCF from operations and $20M of earnings from JVs (2021 was $21M). I have only considered basic shares outstanding and not fully diluted (as they have debentures). The conversion price on the debentures is over $24. From the below table, you can see that I arrive at a Share Price of $18.39 while being conservative in estimates and having a margin of safety of 30%. I am being pretty conservative on the growth rates as well.

METHOD 2: SUM OF PARTS

The company estimates the replacement value of their equipment (including the ones in JV) is ~$2.1B. However, not all the equipment is owned, they rent and lease as well. From the company’s Q2 2022 results, they mention that ~61% of the fleet is owned. Assuming the same holds for their JVs we arrive at a New replacement value of ~$1.3B. We know most of the equipment is going to be used so let’s assume they will go for 40% of the value of new. That equates to about $500M.

How much should I value their backlog? $2B in revenues ($2B backlog by year-end), let’s say they make 10% EBIT on it (2021 Adj EBIT was 11.4%) so $200M, let’s round that off to $150M (PV of money).

How much would one pay for a company that has been in business for over 65 years, has great partners, and assets (rebuild facilities, DGI)? $150M ($100M goodwill & $50M for DGI & rebuild facilities)

Total = $500M (Equipment) + $150M (Backlog) + $150M (Goodwill & facilities)

Total = $800M

The current EV of the company is ~$800M

I think I am being stupid conservative but even then the current price seems fair.

Valuation Conclusion: Normalized business valuation for the company looks like a double from current levels which might be a year from now or 3, who knows. In the meantime, I take comfort in the fact that the management has skin in the game, are excellent capital allocators, and have been in the business over many cycles.

Disclaimer: I own shares of NOA. Nothing on this blog is investing or financial advice. Please see full disclaimer here.