Every time I come across a waste management stock pitch, I roll my eyes expecting a sky-high multiple! I understand why someone would pay a high multiple for a stable and growing earnings stream but I always find the multiple too rich! Finally, I have found a company in the waste business at a reasonable(maybe even attractive?) multiple, with a management team actively working to unlock the valuation gap! Sounds exciting? Before we get into it, here are a couple of important things to remember:

Disclaimer: I own shares of Secure Waste Infrastructure Corp. Nothing on this blog is investing or financial advice. Please see the full disclaimer here.

My last 2 full write-ups (Heartland Express and LGI Homes) haven’t done well so far, I still hold them as I consider them good businesses with excellent management. Something to keep in mind.

Well, with those out of the way, Lets get into it.

Ticker: $SES.TO

Price/Share: $15.34 (Jun 3 2025)

Mcap: ~$3.3B

EV: ~$3.9B

Shares Outstanding: 230.8M (Q1 2025)

Secure is a Waste Management and Energy Infrastructure business mainly operating in Western Canada with a presence in North Dakota as well.

The company has 2 main operating segments:

Environmental Waste Management (~75% Adj EBITDA)

Energy Infrastructure (~25% Adj EBITDA)

Note: All $ are in CAD, unless specified otherwise.

Source: 2025-05 Company Presentation

ENVIRONMENTAL WASTE MANAGEMENT:

Secure provides a critical service mainly to O&G companies in Western Canada and North Dakota by handling their waste streams through the company’s integrated network. Secure’s services include produced and wastewater disposal, hazardous and nonhazardous waste collection, processing and transfer, and treatment of crude oil emulsions.

Secure also manages metals recycling for various customers in Western Canada through its network of metals recycling facilities and rail services.

This segment also includes their specialty chemicals business which develops and sells chemical solutions that optimize exploration and increase production.

Source: 2025-05 Company Presentation

From the above 3 slides, you can see how this is an attractive segment. This segment has high regulatory barriers to entry (permits, suitable location), significant expansion capacity, and scale to optimize the operation.

I’ll give an example to highlight Secure’s dominance in Western Canada in this segment: Secure merged with Tervita, another waste services company in Western Canada, in 2021 in an all-stock transaction. The purchase price was ~$1.4B

Source: Author’s calculation

Post the transaction, Secure had to divest 29 of the 103 Tervita facilities it acquired due to opposition from the competition bureau. Secure sold 30 waste disposal and treatment facilities to Waste Connection for ~$1B in 2024. Secure sold the facilities at a TTM EV/EBITDA multiple of ~7.5.

Source: Company News

The above highlights 2 things

Secure’s strong market share in the region (they currently have ~70% market share).

Savvy management team selling 30% of the acquired assets for ~70% of the purchase price in a distressed sale! (reasonable assumption as I am going by no# of facilities)

The company is also growing the Metal recycling business with the recent acquisition of General Recycling Industries in Edmonton for $162M (Incl Working Capital). This acquisition provides a new hub for Secure’s metal recycling network in Edmonton and helps extract efficiency in its operation network.

ENERGY INFRASTRUCTURE:

This segment has two separate business lines:

Energy Infrastructure

Oil purchase and resale

Energy Infrastructure includes a network of 3 crude oil gathering pipelines, terminals, and storage facilities through which Secure engages in the transportation, optimization, terminalling, and storage of crude oil.

Secure’s oil purchase and resale is mostly a service to improve customer stickiness, this is a zero-margin business. This business line causes huge swings in revenues depending on the price of oil with no effect on gross profits as it is a pass-through. It also makes the profit margins of Secure look bad if one does not back this revenue and expense out!

Source: 2025-05 Company Presentation

The operations of the company has evolved over time due to acquisitions, divestures and allocating capital towards assets generating recurring cash flows.

Source: 2025-05 Company Presentation

In the past, Secure was an energy service company with waste management services. The company’s revenue was dependent on the price of oil as higher oil prices meant more drilling, and their cash flows were 60% weighted towards D&C (Drilling and Completion). Now only 20% of their cash flows are exposed to D&C!

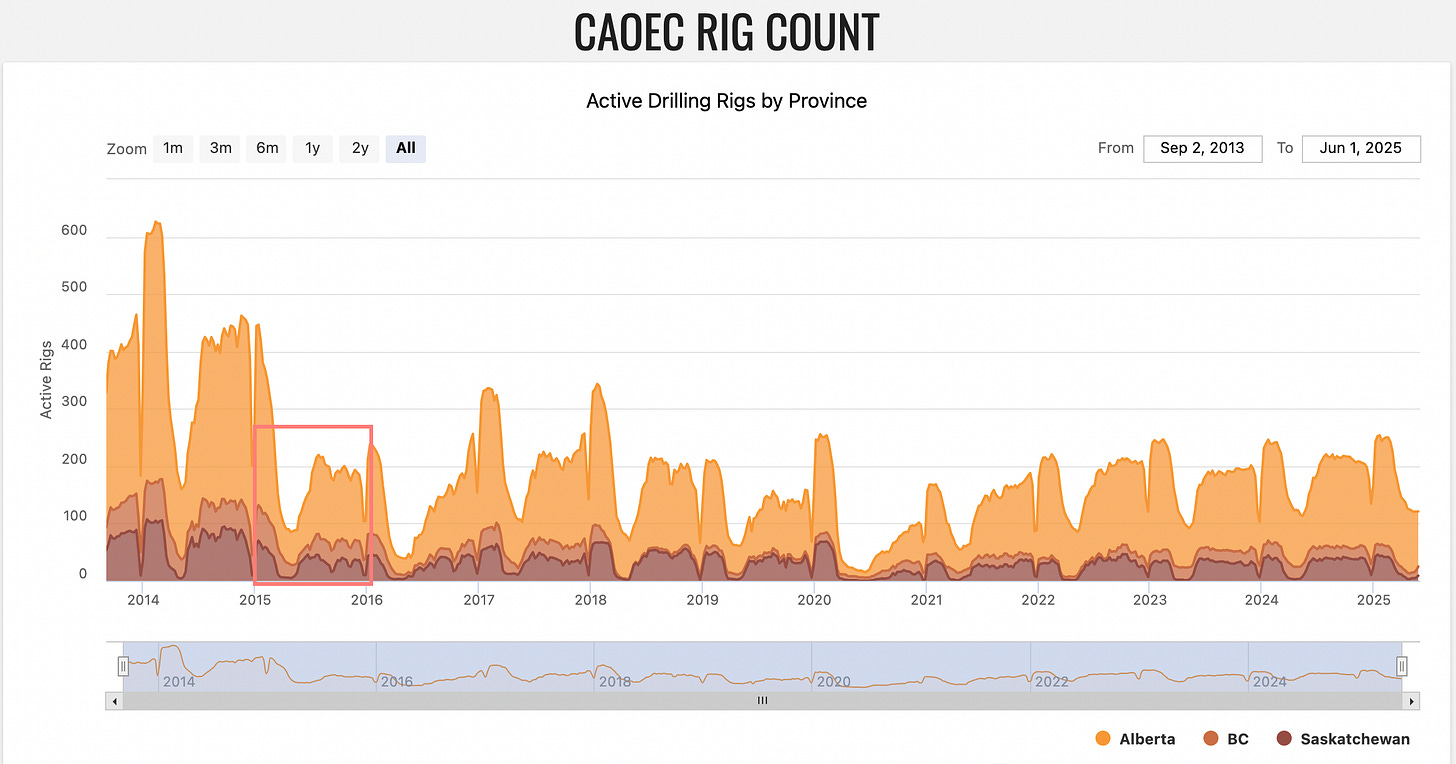

Let’s not take the company’s presentation at face value, lets really check if this is true when oil prices fell. We know oil prices crashed in 2014, and the active drilling rigs dropped in 2015 (see below). The most comparable segment to current operations (due to divestures) from 2015 was Secure’s PRD(processing, recovery and disposal services) division, looking at that we can see operating margins only reduced by 23% YoY, which is inline with what management is saying currently that only ~20% of their cash flows are exposed to D&C.

Source: 2015 MD&A

Source: https://boereport.com/caoec-rig-count/

Now that we have an understanding of what Secure does, let’s take a look at their earnings.

Source: 2024 MD&A

The Adj EBITDA came down in 2024 vs 2023 due to the divestitures of 29 facilities. The company reduced shares outstanding by ~20% YoY. The company expects to earn $510-$540M in Adj EBITDA in 2025 and $270-$300M in DFCF in 2025. At current Mcap the 2025FCF multiple is in the range 11x - 12.2x, which seems quite reasonable to me for a long life asset with growth prospects.

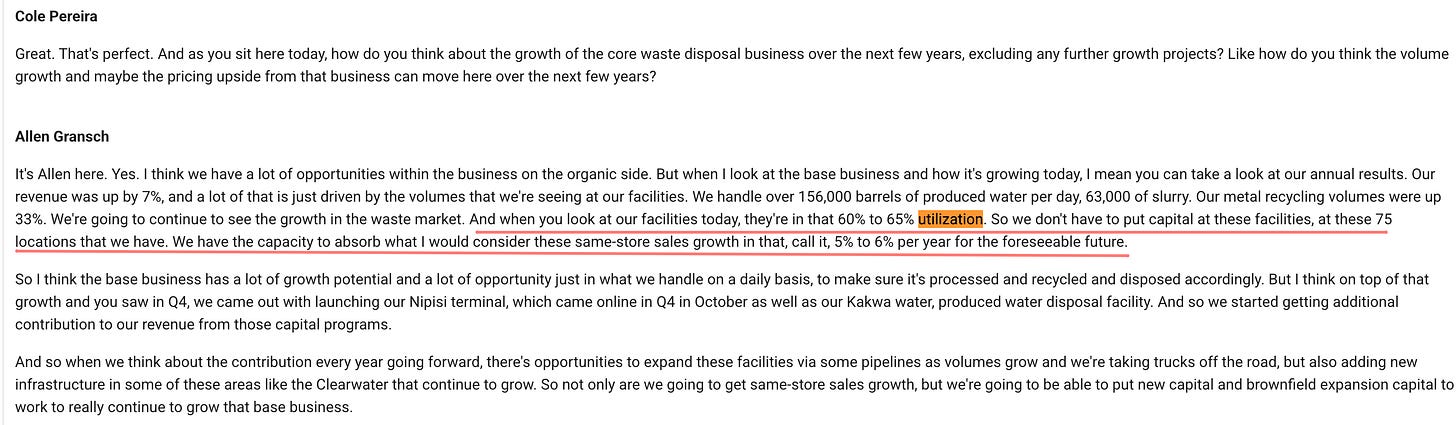

One thing to keep in mind is the sustaining capital is lower than D&A as the company’s facilities are only 60-65% utilized, lots of operating leverage left!

Source: Tikr Q4 2023 call.

The management team in my opinion are good (may even be excellent) capital allocators:

Most management will say their company’s multiple is too low compared to XYZ, this team puts capital to work to close the gap.

2021 Increase due to Tervita acquisition.

The company in Q2 2025 completed an SIB, where they bought back 9.3M shares for $14.5/share! (The SIB was undersubscribed, guess most shareholders like me thought the stock is too cheap to tender!)

Company is also buying back shares in the open market via their NCIB.

They recently backed out of an acquisition as they did not find it compelling during their due diligence process! I like them keeping their hurdle rate high!

Organic investments towards infrastructure projects backed by long term (10 Year) contracts.

Although not a capital allocation decision, the company changed their from Secure Energy Services to Secure Waste Infrastructure Ltd in 2025, to better reflect what the company does.

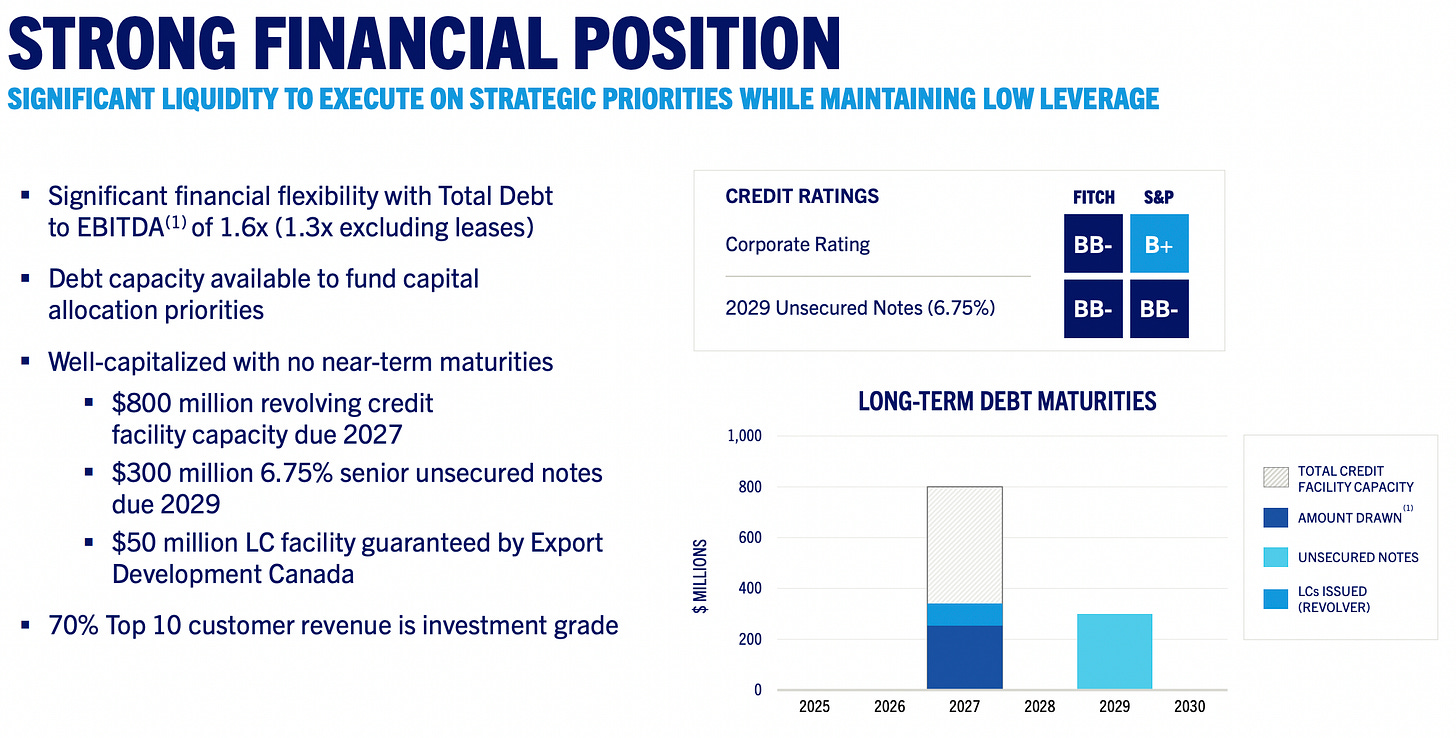

Debt is within 2xEBITDA

Source: 2025-05 Company Presentation

The company’s largest shareholder is TPG Angelo Gordon, who owns 16.1% of shares (As of Dec 2024). Excluding the TPG director on the board, the rest of the management owns only about 1.5% of the shares. I would have preferred if management owned more (via buying shares in the open).

At current prices, I find the investment attractive for a couple of reasons.

When Secure divested 29 facilities in a distressed sale, they did so at ~7.5x TTM EBITDA multiple. The current EV of the company is around the same multiple! This provides us with a floor.

Their facilities are only 60-65% utilized providing high operating leverage in the future, which only improves the multiple.

The company says comparables for their business command higher multiples of EBITDA, it seems like a reasonable multiple for a long-term stable asset.

As long as multiples are depressed, I think management will keep reducing that share count. So at some point in time either the market will value the business correctly or we will realize the market was right all along!

I believe oil production volumes in Canada will continue climbing higher over the very long term, which will be a tailwind.

Source: https://economics.td.com/ca-oil-production-2024

To conclude, I really like the business, management, and growth prospects of the company at its current price. In the long run, I think this will turn out to be a good investment for me.

Below are some excellent write-ups and a video I found really useful.

Disclaimer: I own shares of Secure Waste Infrastructure Corp. Nothing on this blog is investing or financial advice. Please see the full disclaimer here.

Minor Edit: Although not a capital allocation decision, the company changed their "name" from Secure Energy Services to Secure Waste Infrastructure Ltd in 2025